Explore web search results related to this domain and discover relevant information.

We spend it, borrow it and save it. Now let's talk about money and its many minefields, from credit cards to casinos, scammers to student loans.

Trailer: Money, Explained · 22m · 1. Get Rich Quick · Why do people keep falling for financial scams? Dive into the history of con artists and how technology makes it easier for these schemes to flourish. 23m · 2. Credit Cards · The convenience of credit cards comes at a price.Money, Explained · Email address · Email address · Email address · Email address · Email address · Join NowJoin NowJoin NowJoin NowJoin Now · Endless entertainment starting at $7.99 · Money, Explained · Email address · Email address · Email address ·We spend it, borrow it and save it. Now let's talk about money and its many minefields, from credit cards to casinos, scammers to student loans. Watch trailers & learn more.

The time value of money (TVM) is a fundamental principle in finance that explains how the value of money changes over time. Learn the basics, calculations, and applications.

The time value of money (TVM) is the concept that the money you have in your pocket today is worth more than the same amount would be if you received it in the future because of the profit it can earn during the interim. For example, let's say you can either receive a $100,000 payout today or $10,000 per year for the next ten years totalling $100,000.Understanding the time value of money can help you in making decisions ranging from which job has better salary terms, what's a good rate for a loan, or whether the investment you're considering has good growth potential.The time value of money is an important concept to keep in mind because your money, once invested, can grow over time. Even if you were to just put it into a CD or savings account, the money can earn compound interest, and the impact of compounding on investment growth can be significant.On the flip side, money that is not invested will lose value over time. Just think about what you could buy for $1 when you were a child compared to what that same $1 would get you today. This is because inflation and loss of potential earnings erode the value of your dollars.

Research England hopes transparency pilot could lead to more accountability but critics fear bureaucracy and government control

Universities will be asked to explain how they spend millions of pounds received in quality-related (QR) funding from the Research Excellence Framework as part of a pilot study designed to provide greater transparency on institutional spending. Under the study launched by Research England on 9 September, universities have been asked to identify how they allocate their strategic institutional research funding (SIRF), which includes the £2 billion of mainstream QR money awarded annually, QR-related support for research degrees, charity and business-related research, research-related capital funding and other smaller pots of funding for activities such as policy engagement and improving research culture.Research England’s 2022-25 Strategic Delivery Plan published in April 2023 – the funder explains how “quality-related research funding and other types of strategic institutional research funding distributed by Research England can be used flexibly by providers, but evidence isn’t readily available on how HEPS [higher education providers] strategically use their allocations”.“The data collected will be used to strengthen the case for SIRF funding to government,” Research England explains, adding that, “at the completion of the pilot, Research England will determine how and when the new process will be rolled out to all English HEPs annually to obtain better data and insights about SIRF”.

Money is the lifeblood of the economy. It’s the medium of exchange that keeps commerce flowing, allowing us to complete transactions between parties whilst skipping the hassle of bartering.

Money has undergone significant transformations throughout history, evolving from tangible commodities and the barter system to the abstract digital forms we use today. In ancient times, commodity money such as gold, silver and copper were widely used as a medium of exchange.As societies advanced, the need for a more efficient and standardised system of exchange led to the development of fiat money. Introduced in the 20th century, fiat money is a currency that has no intrinsic value but is backed by a government’s decree. Its value comes from the trust and confidence that people have in the issuing authority.In recent years, the rise of digital payments has revolutionised our concept of money. Cryptocurrencies like Bitcoin and mobile payment systems have made money increasingly abstract, allowing for quick and convenient transactions.The concept of money has evolved significantly over time, reflecting the changing needs and values of societies. In ancient times, money was often associated with precious metal, valued for their rarity and durability.

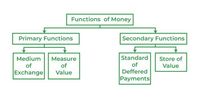

Modern economies use fiat money-money that is neither a commodity nor represented or "backed" by a commodity. Even forms of money that share these function may be more or less useful based on the characteristics of money. ... Explain what makes something useful as money.

Teach about money, jobs, goods, services, and barter. ... Introduce choice, scarcity, and opportunity cost. ... Explain how price signals influence decision-making.This audio assignment covers the functions of money and the differences between commodity, representative, and fiat money.This audio assignment examines money—what three things are in common with all forms of it and the differences between commodity, representative and fiat money.

Research England hopes transparency pilot could lead to more accountability but critics fear bureaucracy and government control

Universities will be asked to explain how they spend millions of pounds received in quality-related (QR) funding from the Research Excellence Framework as part of a pilot study designed to provide greater transparency on institutional spending. Under the study launched by Research England on 9 September, universities have been asked to identify how they allocate their strategic institutional research funding (SIRF), which includes the £2 billion of mainstream QR money awarded annually, QR-related support for research degrees, charity and business-related research, research-related capital funding and other smaller pots of funding for activities such as policy engagement and improving research culture.Research England’s 2022-25 Strategic Delivery Plan published in April 2023 – the funder explains how “quality-related research funding and other types of strategic institutional research funding distributed by Research England can be used flexibly by providers, but evidence isn’t readily available on how HEPS [higher education providers] strategically use their allocations”.“The data collected will be used to strengthen the case for SIRF funding to government,” Research England explains, adding that, “at the completion of the pilot, Research England will determine how and when the new process will be rolled out to all English HEPs annually to obtain better data and insights about SIRF”.

Money is any item or medium of exchange that symbolizes perceived value. As a result, it is accepted by people for the payment of goods and services, as well as for the repayment of loans. Economies rely on money to facilitate transactions and to power financial growth.

Money is a part of everyone's life and we all want it. But, what is it, how does it gain value, and how was it created?Money is any item or medium of exchange that symbolizes perceived value. As a result, it is accepted by people for the payment of goods and services, as well as for the repayment of loans. Economies rely on money to facilitate transactions and to power financial growth.Commodity money solved these problems. Commodity money is a type of good that functions as currency. In the 17th and early 18th centuries, for example, American colonists used beaver pelts and dried corn in transactions. Possessing generally accepted values, these commodities were used to buy and sell other things.Another, more advanced example of commodity money is a precious metal, such as gold. For centuries, gold was used to back paper currency—up until the 1970s. In the case of the U.S. dollar, for example, this meant that foreign governments were able to take their dollars and exchange them at a specified rate for gold with the U.S.

:max_bytes(150000):strip_icc()/GettyImages-1030831244-4279d87f1272423288e24a9ed9925c80.jpg)

If you go back in history, you will see that people have used a number of different things as money, some that had intrinsic value (such as gold and silver), and many that had no intrinsic value of their own (such as seashells and cocoa beans). Currently, all countries around the world use ...

If you go back in history, you will see that people have used a number of different things as money, some that had intrinsic value (such as gold and silver), and many that had no intrinsic value of their own (such as seashells and cocoa beans). Currently, all countries around the world use money that is known as fiat money.From Latin, this term means, “Let it be so.” Essentially, this means that each country prints money on paper (or in some cases, plastic), and that currency is not backed by anything of intrinsic value except the full faith and credit of a country’s Central Bank.In the past, money was backed by silver (the silver standard) or gold (the gold standard). However, that came with its own set of problems. It meant that you had to have silver or gold equivalent in value to the amount of total money you had in circulation. This made it difficult to increase the supply of money in your economy, since you had to acquire enough silver or gold to back up the additional money you wanted to circulate.So, in a way, all paper money is fake! It is, of course, backed by “the full faith and credit” of the country that issued it, but that’s the only thing backing it. That means that unstable countries might end up with currency that cannot be used as payment for oil or food.

The money supply of a country comprises all currency in circulation (banknotes and coins currently issued) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts, savings accounts, and other types of bank accounts).

Bank money, whose value exists on the books of financial institutions and can be converted into physical notes or used for cashless payment, forms by far the largest part of broad money in developed countries.The word money derives from the Latin word moneta with the meaning "coin" via French monnaie. The Latin word is believed to originate from a temple of Juno, on Capitoline, one of Rome's seven hills. In the ancient world, Juno was often associated with money. The temple of Juno Moneta at Rome was the place where the mint of Ancient Rome was located.Many cultures around the world eventually developed the use of commodity money. The Mesopotamian shekel was a unit of weight, and relied on the mass of something like 160 grains of barley. The first usage of the term came from Mesopotamia circa 3000 BC. Societies in the Americas, Asia, Africa and Australia used shell money—often, the shells of the cowry (Cypraea moneta L.The system of commodity money eventually evolved into a system of representative money. This occurred because gold and silver merchants or banks would issue receipts to their depositors, redeemable for the commodity money deposited. Eventually, these receipts became generally accepted as a means of payment and were used as money.Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of ...

Money refers to any verifiable record that is accepted as a medium of exchange for payment of goods and services and repayment of debts in a

Money refers to any verifiable record that is accepted as a medium of exchange for payment of goods and services and repayment of debts in a specific country.The value of money is not necessarily derived from the materials used in its production, but from the willingness of consumers to agree to a displayed value and agree to use this value in future transactions.Traders can store the value of the goods to trade them at a future time and/or different location. Therefore, money makes it possible to save for the future, and participate in transactions in different geographical locations.Money should be durable enough to withstand repeated usage and retain its usefulness for use in future transactions. The commodity or currency should remain functional, without requiring frequent maintenance or repair over its lifetime.

Broad Definition of Money = Money Assets + Near Money ... Three Methods of calculating National Income: Value added Method, Expenditure Method and Income Method ... Explain the Components of Aggregate Supply or National Income.

Your All-in-One Learning Portal: GeeksforGeeks is a comprehensive educational platform that empowers learners across domains-spanning computer science and programming, school education, upskilling, commerce, software tools, competitive exams, and more.Explain the Derivation of Saving Curve from Consumption Curve.Explain the working of Investment Multiplier.Money is anything that is generally accepted as a mode for payment of goods & services and repayment of loans & debts such as taxes, etc., in a particular nation or country. Money was invented to facilitate trade as the barter system, but it can not express the value and prices of goods & services.

Money makes it easy to store wealth in the most convenient, secure, and economical way to meet contingencies and unpredictable emergencies. ... Three Methods of calculating National Income: Value added Method, Expenditure Method and Income Method ... Explain the Components of Aggregate Supply ...

Money makes it easy to store wealth in the most convenient, secure, and economical way to meet contingencies and unpredictable emergencies. ... Three Methods of calculating National Income: Value added Method, Expenditure Method and Income Method ... Explain the Components of Aggregate Supply or National Income.Your All-in-One Learning Portal: GeeksforGeeks is a comprehensive educational platform that empowers learners across domains-spanning computer science and programming, school education, upskilling, commerce, software tools, competitive exams, and more.Explain the Derivation of Saving Curve from Consumption Curve.Explain the working of Investment Multiplier.

Money is a medium of exchange that can be used to facilitate transactions for goods and services.

Monetary Base Explained: Definition, Components, and Examples · Paper Money Explained: Definition, History, Examples · Understanding Currency Depreciation: Causes and Effects · Understanding Minsky Moments: Causes, History, and Real-World Examples · Understanding Economic Shortages: Causes, Types & Real-Life ·Prior to the invention of money, most economies relied on bartering, where individuals would trade the goods they had directly for those that they needed. This raised the problem of the double coincidence of wants: a transaction could only take place if both participants had something that the other needed.The first known forms of money were agricultural commodities, such as grain or cattle. These goods were in high demand and traders knew that they would be able to use or trade these goods again in the future.Money is a system of value that facilitates the exchange of goods and services in an economy, serving as a medium of exchange, a unit of account, and a store of value.

:max_bytes(150000):strip_icc()/terms_m_money_FINAL-bc556f9023f64a15b177e7768124f125.jpg)

Paper Money Explained: Definition, History, Examples

Money is a part of everyone's life and we all want it. But, what is it, how does it gain value, and how was it created?Money is any item or medium of exchange that symbolizes perceived value. As a result, it is accepted by people for the payment of goods and services, as well as for the repayment of loans. Economies rely on money to facilitate transactions and to power financial growth.Commodity money solved these problems. Commodity money is a type of good that functions as currency. In the 17th and early 18th centuries, for example, American colonists used beaver pelts and dried corn in transactions. Possessing generally accepted values, these commodities were used to buy and sell other things.Another, more advanced example of commodity money is a precious metal, such as gold. For centuries, gold was used to back paper currency—up until the 1970s. In the case of the U.S. dollar, for example, this meant that foreign governments were able to take their dollars and exchange them at a specified rate for gold with the U.S.

M. Shannon Hernandez, Founder and CEO of Joyful Business Revolution™, says women are socialized to soften their money language. “We apologize for our rates, over-explain when raising prices or accept terms we never agreed to,” she says.

Understand assertive money talk and the hidden challenges for even highly successful women. Learn strategies to build confidence, respect and wealth.Clare J. Hefferren, Strategic Architect at WonderPact, addresses intergenerational patterns. “The challenge is reclaiming inner authority after generations of being taught to stay agreeable or invisible around money.”Assertive money talk matters not just for investments, spending and earnings but also for self-confidence and respect in relationships at home and work.I wasn’t always financially assertive and I paid the price of people-pleasing, being too nice and allowing others to take advantage of me. That led to low self-worth, depression and anxiety, financial problems and relationship conflict. I decided things had to change. I found my voice and learned how to talk about money and avoid the cost of silence.

Money refers to any verifiable record that is accepted as a medium of exchange for payment of goods and services and repayment of debts in a

Money refers to any verifiable record that is accepted as a medium of exchange for payment of goods and services and repayment of debts in a specific country.The value of money is not necessarily derived from the materials used in its production, but from the willingness of consumers to agree to a displayed value and agree to use this value in future transactions.Traders can store the value of the goods to trade them at a future time and/or different location. Therefore, money makes it possible to save for the future, and participate in transactions in different geographical locations.Money should be durable enough to withstand repeated usage and retain its usefulness for use in future transactions. The commodity or currency should remain functional, without requiring frequent maintenance or repair over its lifetime.

Money has a long and complicated history that follows civilization practically from its birth. Read on to learn more about money and how it works.

What Is a Motley Fool Moneyball Score? Our AI-Powered Investment Tool Explained · Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. View Premium Services ·The dollars in your wallet have a value. But in the past, so have beaver pelts, silver bars, and even enormous stones. Money might make the world go 'round, but it's not exactly a concrete concept that has remained static.Rather than requiring bartering items with unstable values and where demand may not be as universal as hoped, money possesses both transferability and divisibility, even if that money is in an early form -- what's called "commodity money." Commodity money is somewhere between random baskets of eggs and paper cash.Beaver pelts were actually a popular form of commodity money in the early United States since they were abundant, useful, and easy to trade. But over time, the beaver trapping world fell away, and mining became a more common trade, birthing metal as currency in the U.S.

money, a commodity accepted by general consent as a medium of economic exchange. It is the medium in...

The use of metal for money can be traced back to Babylon, prior to 2000 BCE. Standardization and certification in the form of coinage did not occur except perhaps in isolated instances until the 7th century BCE.This common knowledge makes the pieces of paper valuable because everyone thinks they are, and everyone thinks they are because in his or her experience money has always been accepted in exchange for valuable goods, assets, or services. At bottom money is, then, a social convention, but a convention of uncommon strength that people will abide by even under extreme provocation.The strength of the convention is, of course, what enables governments to profit by inflating (increasing the quantity of) the currency. But it is not indestructible. When great increases occur in the quantity of these pieces of paper—as they have during and after wars—money may be seen to be, after all, no more than pieces of paper.If the social arrangement that sustains money as a medium of exchange breaks down, people will then seek substitutes—like the cigarettes and cognac that for a time served as the medium of exchange in Germany after World War II. New money may substitute for old under less extreme conditions.

The three-month pause to re-examine the assessment of ‘people, culture and environment’ could prelude a welcome reversal, says Alice Sullivan

Home Media Explainers Research & Publications Statistics Monetary Policy The €uro Payments & Markets Careers ... This quiz tests your basic knowledge on what ''money'' actually means.

The European Central Bank (ECB) is the central bank of the European Union countries which have adopted the euro. Our main task is to maintain price stability in the euro area and so preserve the purchasing power of the single currency.Find out about three types of money and three things only money can do.

:max_bytes(150000):strip_icc()/GettyImages-1030831244-4279d87f1272423288e24a9ed9925c80.jpg)

:max_bytes(150000):strip_icc()/terms_m_money_FINAL-bc556f9023f64a15b177e7768124f125.jpg)